inheritance tax changes 2021 uk

The extension to the previous 2004 regulations to include an updated definition of Excepted. When you die assets left to your spouse or registered civil partner provided theyre living in the UK are exempt from inheritance tax.

How To File Your Uk Taxes When You Live Abroad Expatica

Instead the donee will take over the base costs of the donor.

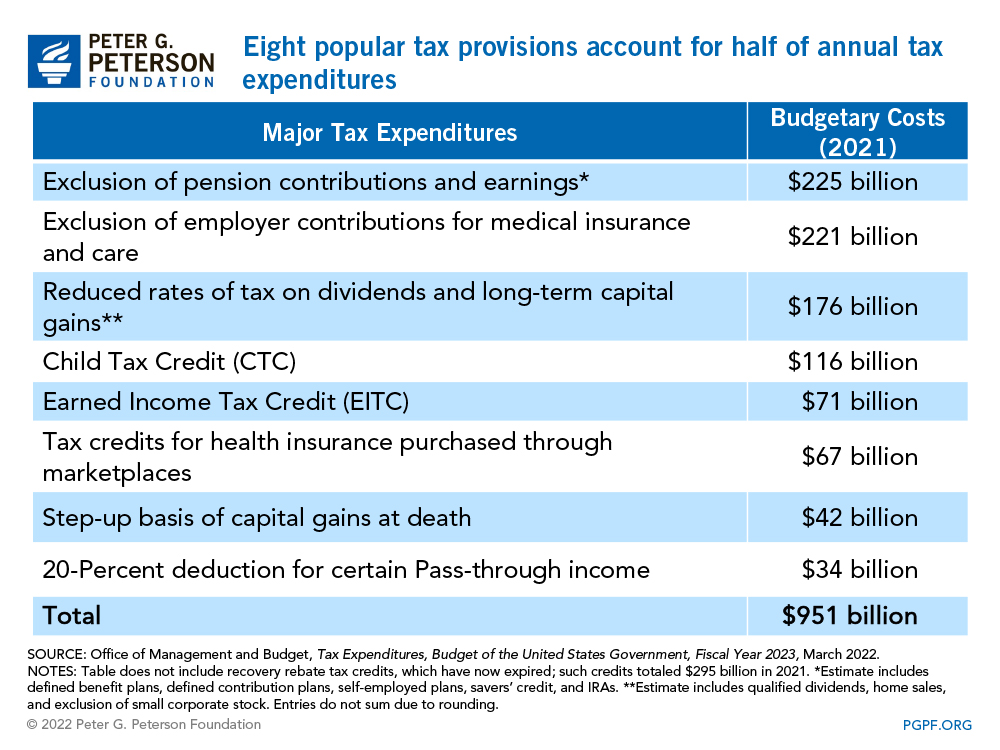

. Inheritance tax changes 2021 uk Friday June 10 2022 Edit. The residence nil rate band RNRB has increased by 25000 each year since its introduction on 6 April 2017. Above this dividend income tax-free allowance you pay tax based on the rate you pay on your other income - known as your tax band or sometimes called your marginal tax rate.

The estate can pay Inheritance Tax at a reduced rate of 36 on some assets if. Reducing the IHT tax rate of 40 to a rate of 10 for estates up to 2m 20 for estates over 2m. Budget 2021 - Changes to Inheritance Tax Posted on 29th April 2021 at 1236 With the Chancellor announcing in the budget this year that the inheritance tax thresholds will be frozen at the existing levels until April 2026 have you made the most of your tax free allowances.

If you sold property between 6 April 2020 to 26 October 2021 you would have been required to report and pay the CGT within 30 days. Who can inherit my property tax-free. If the person died on or before 31 December 2021 no IHT205 form needs to be completed if it is an excepted estate or they do not need a probate.

The inheritance tax IHT nil rate band NRB has been at its current level of 325000 since 6 April 2009. Tax rates and allowances. In addition to the standard rate of Inheritance tax relief which sits at 325000 an allowance for family homes that are passed on to direct descendants children and grandchildren was also introduced which started at 100000 in 2017 and increased to 175000 for the tax year 202021.

So this tax year 202021 is the final year of the. In addition the residence nil-rate band will also be frozen at 175000When added to the IHT threshold of 325000 it allows each individual to pass on 500000 with no IHT payable - or 1m per couple. The Office of Tax Simplification OTS has made some recommendations and proposals to overhaul Inheritance Tax IHT.

The tax body stated. The property allowance will be layered on top of your. Reducing the annual allowance would mean more people.

Inheritance tax reporting change. 9 Ways To Pay Less Inheritance Tax Financial Advisor Bristol See the situations where inheritance tax may apply in relation to pensions. The person died on January 2 2022 leaving an estate worth 285000 which is below the inheritance tax threshold.

Inheritance Tax Changes in 2022. These included aligning rates of CGT to income tax levels and cutting the annual gains allowance from 12300 to as little as 2000 per person but with fewer assets attracting the charge. There is a tapered.

The limit for chargeable trust property is increased from 150000 to 250000. In accordance with the new changes if a person has died on or after 1 January this year only the value of their estate needs to be reported when applying for a probate. In January 2022 inheritance taxes have changed again to simplify the process of reporting an estate.

In 2021 the government implemented changes to the inheritance tax nil-rate band saying that current nil rate bands would remain at existing levels until April 2026. Inheritance Tax Changes - What You Need To Know. On death it has been suggested that there will be no tax free uplift the donee inherits at the donors base cost.

Basic-rate taxpayers pay 75. Taxes are never popular but Inheritance Tax IHT is arguably subject to more criticism than any other. The OTS review of CGT published in September suggested four key changes as part of an overhaul.

For lifetime gifts there would be no capital gains tax on the gift. On top of this your partners inheritance tax allowance rises by the percentage of your allowance that you didnt use meaning together a couple can currently leave 1 million tax-free 2 x 325000 tax-free allowances 2 x 175000 main residence. Tax changes may catch high earners short - Inheritance Tax pension rules reform fears TAX CHANGES are something which many have been speculating about following the Chancellor of the Exchequer Rishi Sunaks unprecedented public spending in response to the coronavirus pandemic.

Following the announcement to freeze a number of tax thresholds at Budget 2021 the NRB is set to remain at that level until at least 5 April 2026. The government has announced that the inheritance tax IHT threshold will remain frozen at 325000 until 20252026. On the 1 January 2022 The Inheritance Tax Delivery of Accounts Excepted Estates Amendment Regulations 2021 came in to force significantly changing the requirements for many Personal Representatives when administering smaller non-taxpaying estates.

How it works what you might get National Insurance. The Inheritance Tax charged will be 40 of 175000 500000 minus 325000. 05 March 2020 1145.

Find out morecapital gains tax rates and allowances. For exempt estates the value limit in relation to the gross. The tax-free dividend allowance has stayed the same for the 2021-22 tax year at 2000.

Often referred to colloquially as death tax it is a levy that is placed on estates that are worth more than the IHT threshold. 15 October 2021 1423. Whilst these proposals may look good on the surface the devil is in the detail.

This is only for properties sold on or after 27 October 2021. We know inheritance tax law can be complicated so weve put together this guide to the inheritance tax changes in 2022. In March 2021 the government announced changes in IHT which will become.

The Ultimate Guide Of Over 50 Money Saving Tips For 2022 Money Saving Tips Saving Money Best Money Saving Tips

How To Avoid Inheritance Tax In The Uk 7 Legal Loopholes To Cut The Cost

How To Avoid Inheritance Tax In 2022 And Save Your Family 140k

How To Plan For April S Upcoming Tax Changes Ftadviser Com

How Does The Personal Representative Deal With The Income And Capital Gains Arising After The Deceased S Death Low Incomes Tax Reform Group

Spendthrift Trusts May Sound Like You Re Trying To Keep Your Kids From Frittering Away Your Legacy But They Are Not Ju Travel Outfit Summer Inheritance Casual

Utah Tax Rates Rankings Utah State Taxes Tax Foundation

How Do Marginal Income Tax Rates Work And What If We Increased Them

Why Capital Gains Tax Reform Should Be Top Of Rishi Sunak S List Autumn Budget 2021 The Guardian

How Much Inheritance Tax Will I Pay In 2022 And How Can I Reduce Or Avoid It

Baroness Bruck Baronessbruck Twitter Hypocrisy Baroness Guy Martin

How To Make Your Financial Windfall Actually Change Your Life Money Strategy Money Saving Advice Get Cash Fast

Tax Information Every Musician Should Know Diy Musician

Named In The Will What To Know About Canadian Inheritance Tax Laws 2022 Turbotax Canada Tips

The Complete Guide To The Uk Tax System Expatica

One Page Construction Communication Plan Template Google Docs Word Apple Pages Pdf Template Net Communication Plan Template Communications Plan Communication Process

How To Avoid Estate Tax In Bitlife Pro Game Guides

How To Escape Paying 975 000 Inheritance Tax With This Secret Trick In 2022